The big crash is coming soon⁉️ : The least you need to know right now.

The big crash is coming soon⁉️ : The least you need to know right now.

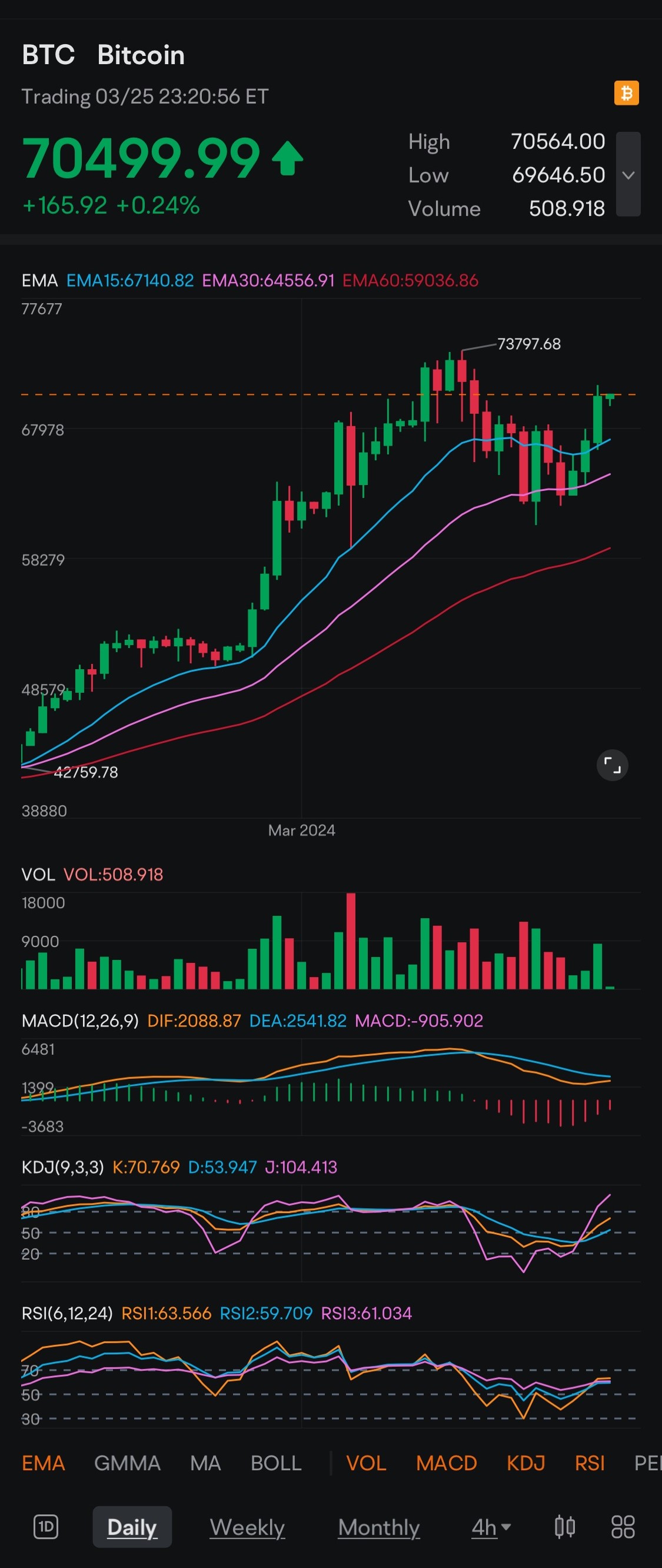

1. bitcoin

Bitcoin briefly hit an all-time high of over $73,000, but a subsequent correction has seen it fall to around $60,000 now, and then back above $70,000.

Why has it been bought so much?

Before answering that question, let us review the overall market situation.

2. U.S. economic indicators (inflation data)

Currently, the U.S. stock market is struggling with persistent inflation data.

The Consumer Price Index (CPI) rose 3.2% y/y in February, slightly above market expectations of 3.1%. The core CPI excluding food and energy, which indicates underlying price trends, also rose 3.8% y/y, exceeding the market forecast of 3.7%. The month-on-month CPI also rose 0.4%, indicating that the pace of inflation is slowing, although the trend of slowing inflation continues.

The Producer Price Index (PPI) also increased by 0.6% month-over-month in February, exceeding market expectations of a 0.3% increase. On a year-on-year basis, PPI rose 1.6%, exceeding market expectations of a 1.2% increase.

Expectations of an early interest rate cut were on the wane.

U.S. retail sales in February increased 0.6% from the previous month to $700,727 million (approx. 104 trillion yen). This is the first positive change in two months, but fell short of market expectations of a 0.8% increase, and the weak retail sales suggest a slowdown in the economy.

However, the FOMC meeting last week left the number of rate cuts for the year unchanged at three, despite raising its growth and inflation forecasts. This also meant that they would remain unchanged at three rate cuts even if the labor market remained strong.

This was perceived by the market as a dovish move, and the market is turning risk-on.

3.WTI Crude Oil

WTI crude oil broke through the $80/barrel barrier, suggesting further inflationary pressures. This trend reflects a shift in the balance of supply and demand in the energy market, but higher prices for oil, which can be used as a raw material for everything, will fuel inflationary fears. The price of WTI is rising further as the Fed is allowing inflation to rise.

4.Currency Exchange (USD/JPY)

Until last week, the dollar's strength had been noticeable as expectations of an early rate cut faded, but after the FOMC meeting, the dollar fell on expectations of a rate cut.

However, the BOJ famously stated that it would "maintain an accommodative environment" after lifting negative interest rates. In other words, it gave the market the impression that it would lift negative interest rates but had no intention of raising interest rates thereafter.

As a result, although the dollar fell temporarily, the market judged that the difference between the U.S. and Japanese interest rates would not narrow, and the dollar remained in the low 151-yen range, with the dollar continuing to be strong.

We recognize that this move is not a case of viewing the dollar as a safe-haven asset, but rather as a kind of process of elimination, where market funds have no choice but to go here because interest rates remain high. As a result, it has created a sense of uncertainty about the overall market outlook.

5. demand for gold

Under these circumstances, demand for gold and cryptocurrencies is likely to increase, but interest rates are still a bottleneck. However, while it is difficult to move up, we believe there is strong support to the downside.

China, in particular, has been reducing its holdings of dollars in its foreign exchange reserves and accelerating its purchases of gold as it deepens its standoff with the United States.

This is a factor that will strengthen downside support for the gold price.

6. demand for bitcoin (why bitcoin now?)

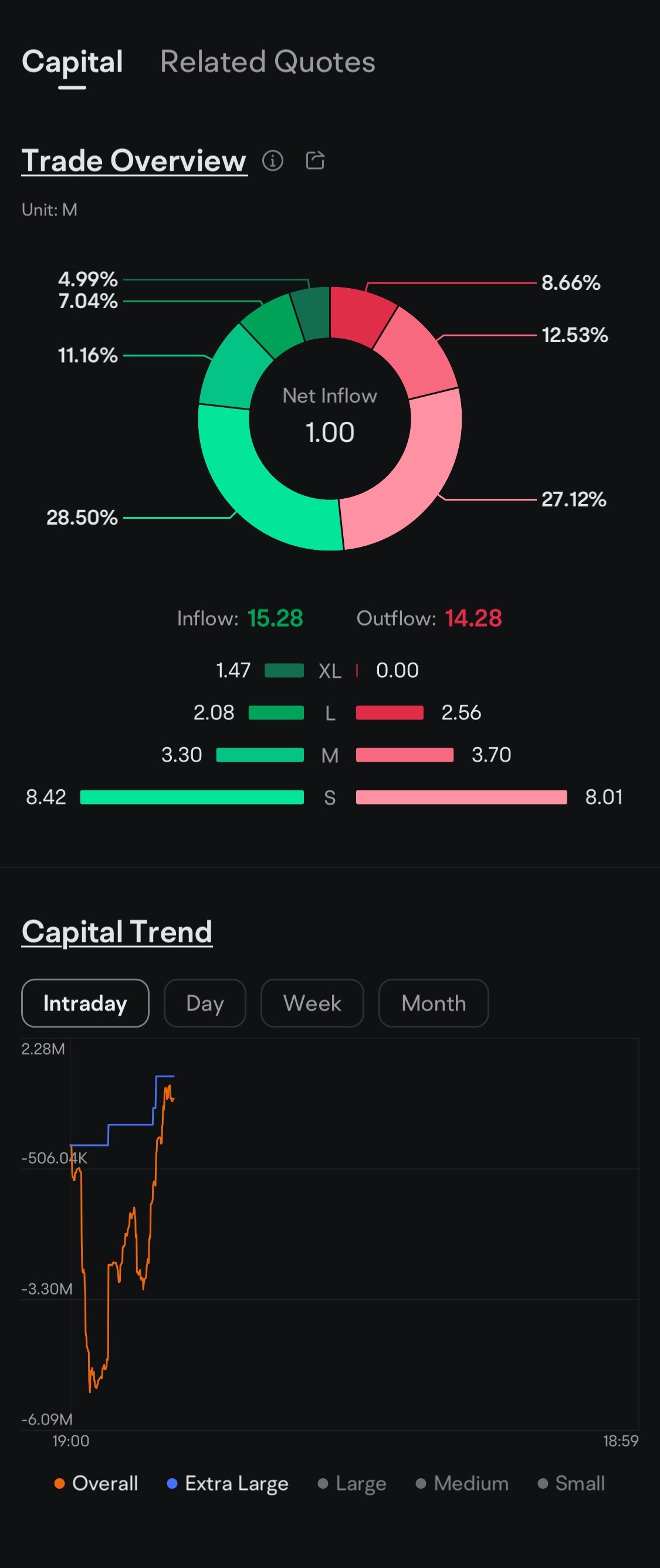

In contrast to gold, cryptocurrencies, especially when it comes to bitcoin, are booming with ETFization of spot Bitcoin and expectations of a halving. As was the case with ETFization of spot Gold in the past, the inflow of funds is likely to continue with spot bitcoin ETFs.

Given the success of the physical gold ETF conversion, the energy of regret from those who have given up gold early, combined with the energy of those who are moving from gold to bitcoin, etc., will increase the appetite for investment in cryptocurrencies as a whole.

Another reason for the current interest in bitcoin is that owning digital assets is now considered a form of personal asset building. Individual investors are increasingly adding bitcoin to their portfolios to diversify risk and maximize profits.

These factors are driving the demand for cryptocurrencies in the market.

7. gold vs. bitcoin

Let us now compare gold and bitcoin.

Gold has a solid underlying price due to the dual reassurances of the existence of a physical object and the fact that the world's major central banks have been buying more and more of it.

However, when it comes to the future, There is nothing but a sense of relief there. (and sometimes this is the most important thing), so it would be advantageous in the event of a real emergency such as a financial crisis, disaster, or war.

On the other hand, in the case of Bitcoin, although there are concerns about the lack of a physical object, expectations and trust in the blockchain mechanism are very high, and it can be used to record all transactions and verify whether or not they have been tampered with later, and from here it can be used for DeFi (decentralized finance), NFT (non-falsifiable (decentralized finance), NFT (non-falsifiable token), WEB3 (decentralized Internet), and Metaverse (3-dimensional virtual space). (This is an area where blockchain has excelled since Ethereum.)

Another aspect is that it provides a mechanism to protect the value of one's assets. It reduces the risk of inflation by having a substantially limited number of bitcoins issued.

The event for this is the halving, and each halving increases the difficulty of issuing bitcoins, which has so far caused their price to rise.

Now, if the SEC (U.S. Securities and Exchange Commission) approves the conversion to a spot bitcoin ETF, the value of the asset as a financial asset is officially recognized.

This is comparable to gold in that, unlike legal tender issued by a central bank, it is a valuable asset over which one has no control over the amount issued. This is why it is called "digital gold.

8. Future of Crypto Assets (Blockchain)

In the future, bitcoin may become increasingly popular due to the advancement of digitization. More and more people are expected to use bitcoin for online payments, international money transfers, and other transactions due to the convenience of being able to do so without having to go through a bank.

And crypto assets are not only for speculative purposes, but are also involved in pioneering next-generation business models, such as high-tech companies and start-ups. Companies adopting them will be closely watched, and future business trends will be expected.

Given all of this, bitcoin would be overwhelmingly stronger in the event of a stock market downturn or financial crisis, but analogously, physical gold would be stronger in the event of a disaster or war involving a major city.

It is also customary for the dollar to be strong in a situation where long-term interest rates are high, even in a low stock market, but if it outperforms those rates, bitcoin and other cryptocurrencies will naturally rise.

Furthermore, if ethereum becomes a spot ETFs, it will create another investment opportunity in the cryptocurrency market and attract even more money (although this one is a bit further away...).

This will naturally lead to higher expectations for other Ethereum-killer L1 blockchains to be converted to ETFs, as well as expectations for L2 blockchains, which are expected to solve Ethereum's scalability issues, and the accompanying rise in popularity of meme coins, which are also expected to expand the market. These factors are expected to expand the size of the market.

From these perspectives, I think we can confirm that it is essential to pay attention to the trends in the crypto asset market, regardless of which assets you invest in.

9. key points for this week

The most important point of the week is the release of the PCE Core Deflator on Friday the 29th. This is said to be the most important economic indicator for the Fed as a price index.

The tide may turn after this release, so please be careful.

As for Bitcoin, it is unlikely that it will rise above its all-time highs until Friday, so it is best not to chase it higher.

If it does go above the highs, it would be wise to wait until it comes back to around yesterday's highs.

However, there is no need to be bearish. Even if you grabbed it at a high price, if you wait patiently, it is likely that it will eventually cross it.

1: $60,000

2: $52,000

3: $45,000

4: $38,000

I hope the above has convinced you why bitcoin is the way to go now.

I wish you all the best of luck!

アカウントを作成 して、もっと沢山の記事を読みませんか?

この記事が気に入ったら BlackMoon - 暗号資産 投資情報部🪙(Crypto Investment Insights) さんを応援しませんか?

メッセージを添えてチップを送ることができます。

この記事にコメントをしてみませんか?